The Difference Between a Stabilization Fund and an OPEB Trust

June 27, 2022|Kurtis Thompson

Bottom Line Up Front

- A Stabilization Fund and an OPEB Trust are both funding tools set up by Municipalities to set aside funds.

- While a Stabilization Fund is a regular component of the balance sheet, an OPEB Trust is specifically for Other Post Employment Benefits.

- The biggest difference between these two funding tools is that an OPEB Trust can impact your financial statement by lowering your discount rate and your Net OPEB Liability.

There’s substantial confusion surrounding public finance funding options. With the considerable number of rules, regulations, stakeholders, and services that need funding, it’s easy to get overwhelmed. If you’re considering setting aside funds for your OPEB liabilities, it’s important to understand all of your options and how it can impact your financial statement.

What is a Stabilization Fund?

First, let’s define what a Stabilization Fund is. A Stabilization Fund is an account that Municipalities use to set aside money for future capital needs, unforeseen spending, or to smooth shocks for their taxpayers. It allows Municipalities to save money in good years for lean years or for large future capital expenditures.

How an OPEB Trust differs from a Stabilization Fund

So is an OPEB Trust just a Stabilization Fund that’s set up to save for future OPEB costs? Not exactly – an OPEB Trust has different requirements than a Stabilization Fund. Based on GASB 74, an OPEB Trust has three specific requirements that differentiate them from Stabilization Funds.

GASB 74 states that an OPEB Trust must have the following three features:

- Contributions to the Trust and earnings thereon must be irrevocable.

- Trust assets may only provide the funds for other post-employment benefits per plan terms. Therefore, assets accrued may not revert to the plan sponsors until all obligations have been satisfied.

- OPEB Trust assets must be legally protected from the creditors of employers, contributing entities, and plan members.

Essentially, these three characteristics make an OPEB Trust legally protected from any use other than paying for OPEB benefits owed to retirees.

Let’s look at a worst-case scenario to demonstrate this – imagine that the Municipality goes bankrupt. A Stabilization Fund set up for OPEB benefits may be used to pay off other debts owed by the Municipality and would be subject to their creditors, but funds in an OPEB Trust would be legally protected and could only be used to pay the benefits promised to retirees. Nobody and nothing else can touch them.

How does this affect my financial statement?

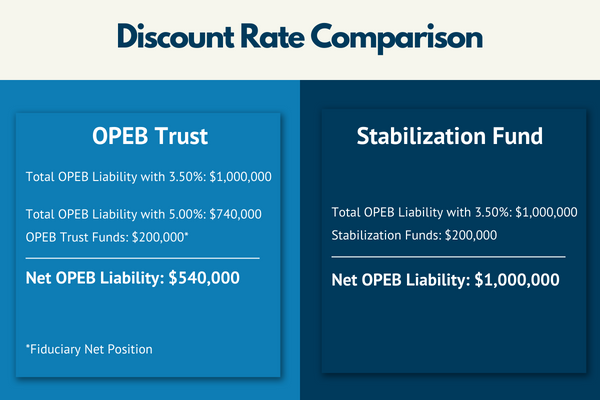

Either way, the funds in an OPEB Trust or Stabilization Fund will count as an asset on the financial statement. However, based on GASB 74 & 75 standards, only funds in an OPEB Trust may be counted as “Fiduciary Net Position” (i.e. Asset) on the OPEB section of the financial statement. Fiduciary Net Position decreases the Net OPEB Liability reported on the financial statement. Take a look at the example below:

The funds in the Stabilization Fund don’t count from a GASB 74/75 perspective!

Another major impact is that stabilization funds are not considered in the calculation of the discount rate. If we can count the funds being set aside for OPEB benefits, GASB 74/75 standards allow the Actuary to increase the discount rate. A higher discount rate leads to lower disclosed liability. So, the $1,000,000 stated above might actually decrease even more. Here’s another example:

How are the funds invested?

The last consideration we’ll address here is the difference in investment options for Stabilization Funds and OPEB Trusts. In general, Stabilization Funds are held in cash or cash equivalents with the corresponding low and stable returns of such investments. OPEB Trusts can be invested in many more financial instruments and generally hold a mixture of stocks, bonds, mutual funds, alternative investments, and cash or cash equivalents.

The difference in investing vehicles reflects that an OPEB Trust is generally invested for the “long term” while Stabilization Funds tend to be for the “short term” or on-demand funds. Correspondingly, a Municipality would expect to earn a higher rate of return on funds in an OPEB Trust over the long term if they invested in non-cash or cash equivalent investments.

In Summary

An OPEB Trust allows the assets to be reflected on the Actuarial Valuation for the OPEB plan, a Stabilization Fund does not. Money in a Stabilization Fund is more flexible while money in an OPEB Trust can only be used to pay for retirees’ OPEB benefits. Is there still a place for Stabilization reserves to support an OPEB plan? Yes, there certainly can be. However, keep in mind that GASB 74 & 75 put pressure on Municipalities to “upgrade” their Stabilization Funds to OPEB Trusts to reap the full benefits of those funds on the Financial Statement.

If you’re still not sure which fund is right for your Municipality, you can reach me or one of our Odyssey Consultants here.

About The Author Kurtis has been a consultant on the Odyssey Advisors team since 2013 and has developed extensive knowledge and expertise in developing and administering retirement benefit solutions. Kurtis is passionate about helping people achieve the retirement they’ve always dreamed of...

More Insights From This author