9 Things to Review for Your OPEB Census Audit

July 25, 2022|Parker Elmore

Bottom Line Up Front

- You may be asked to review census data used for the OPEB valuation under GASB 74/75 as part of an annual audit process.

- While actuaries will ask for any number of census data, there are several key elements that have an impact on OPEB liabilities so it’s important to understand what those elements are and how they affect those liabilities.

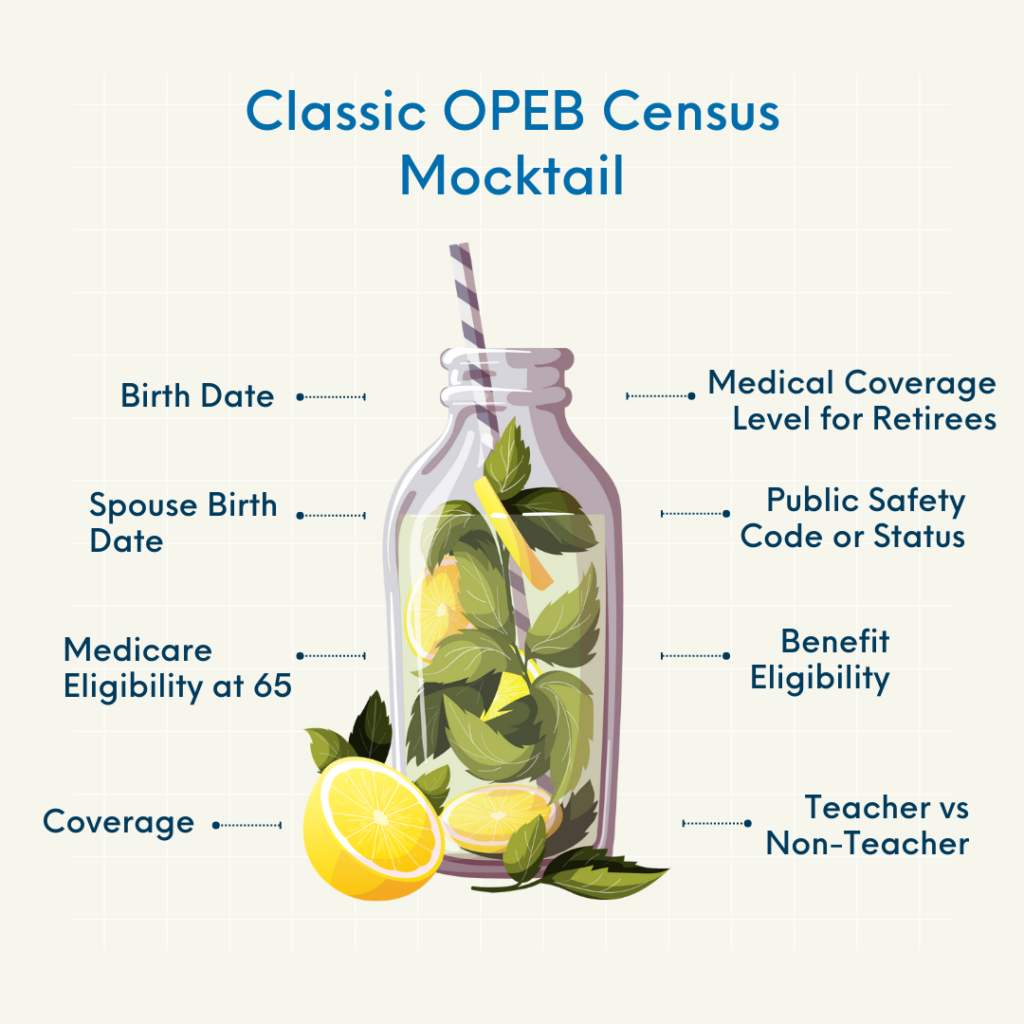

- The top 9 elements you should review include the birth date, spouse birth date, hire date, medicare eligibility at 65, medical coverage level for retirees, public safety code/status, teacher versus non-teacher, and coverage.

As part of the annual audit process, you may be asked to review the census used for the OPEB valuation under GASB 74/75. While there are many elements to the census files provided to the actuaries, many have little to no impact on OPEB liabilities. So, we wanted to share the critical census elements to review and their materiality on the OPEB valuation results.

Here Are The Top 9 Things to Review For Your OPEB Census Audit

- Birth Date

This should be obvious as age impacts liability. For active employees, birth date errors will understate liabilities if they are older than the date provided. For retired employees and their covered spouses, the concern is that they are younger than the data provided as younger retirees/spouses have higher liabilities.

- Spouse Birth Date (for Retirees)

Absent the actual DOB, most actuaries will utilize an assumption such as male spouses are three years older than their female spouses and same-sex spouses are the same age. Ideally, the employer will provide actual spouse birth dates as that can cause a material difference in the case of a younger spouse.

- Hire Date

Given that most OPEB plans have a service requirement to be eligible for benefits in retirement, this is important. If they have prior credited service that’s not reflected on their hire date, their liability will be understated. Also, for plans with longer service requirements, an incorrect (newer) hire date may lead to them having zero valuation liability as they would not meet the eligibility requirements for valuation purposes.

Also, be aware of employers where they populate the hire date field with the date the person started in the position (e.g., the employee gets promoted to manager and the hire date is the date of promotion or job change and not their original date of hire).

- Medicare Eligibility at Age 65

Those retirees who are over age 65 and remain on active healthcare plans will have liabilities 3-4 times higher than they would if they were enrolled in a Medicare Supplement plan. So it’s important to identify as such to avoid understatement of liabilities. We also ask them to identify anyone who they believe will not be eligible at age 65 (usually teachers hired before March 1986) but that it is iffy as they may have earned Medicare credits elsewhere over the years.

- Medical Coverage Level for Retirees

The existence of a covered spouse or lack thereof materially impacts figures.

- Public Safety Code or Status

Many retirement systems have differing retirement eligibility requirements for designated public safety personnel. As such, they will be able to retire earlier and are likely to have higher OPEB liabilities than their municipal counterparts. So, failure to identify those eligible for public safety retirement benefits would understate a liability.

Also, for those groups that have Municipal Utility Districts, a subset of those employees are often eligible for such public safety retirement benefits so you may want to review their coding as well.

- Benefit Eligibility

This only applies to active employees but many employers will provide an expansive census that includes those who are part-time and not eligible for benefits. Failure to identify those not eligible for benefits will result in an overstatement of liabilities.

- Teacher vs. Non-Teacher

For schools or employers with school groups, teachers are often assumed to have lesser mortality and retire earlier than other school personnel. Ideally, the employer will identify those who are teachers as they have higher liabilities based on the assumptions noted. If there is no identification, the actuary should assume the percentage or share of the school population that are teachers.

- Coverage

Are all groups included (e.g., did the employer remember to include teachers, business-type groups, or subsets of retirees)?

To Summarize

The above list is designed to audit the census for OPEB healthcare or medical benefits. For life insurance, birth dates are obviously crucial, and salary would matter for pay-related life insurance benefits (however, for most employers life insurance liabilities are immaterial as compared to medical insurance liabilities). In the case of dental insurance, many of the above elements are important if the employer subsidizes the coverage.

As with any audit, it’s about materiality. Birth dates that vary by months or a few years will not materially impact liabilities, but if it’s a systemic issue that should be addressed. The size of the census will also impact the materiality of any particular census anomaly.

If you have questions on the impact of a particular census issue, you should contract the actuary to determine the size, materiality, and if a new report should be issued.

If you have any questions regarding what to look for during an OPEB census audit, please reach out to me or any of our Odyssey consultants.

For more information on everything you need to know about OPEB, check out our learning center today!

About The Author As President and CEO of Odyssey Advisors, Parker Elmore is dedicated to quality service, expertise, and efficiency. With over 25 years of industry experience, Parker and the Odyssey team develop and implement solutions to the complex financial issues faced by...

More Insights From This author

October 2, 2024

Parker Elmore

August 28, 2023

Parker Elmore