401(k) Plan Design: An Overview

March 7, 2024|Luke Matchett

Bottom Line Up Front

- Understanding the elements of 401(k) plan design can help you mold your plan to fit your company’s and employee’s needs.

- 401(k) plans are not one-size-fits-all; they require careful consideration and customization to suit individual circumstances and goals.

- Some of the features you’ll need to narrow down when starting a 401(k) include the plan type, contributions, vesting, and distributions, among others, to ensure alignment with your company’s objectives.

A 401(k) plan is a popular retirement savings vehicle. It is an employer-sponsored retirement plan that allows employees to save for retirement. Whether you’re looking to start offering one or upgrade your current plan, it’s important to know that the specifications of your 401(k) plan can vary based on your design choices.

1. Eligibility

Who will be allowed to participate in the plan? Legally, there are a few parameters that state a company must allow an employee to participate in their qualified plan if they:

- Are 21 years old

- Have one year of service (1,000 working hours or more within 12 months)

As the employer, you have the option to allow employees to participate in the plan earlier than these requirements. Having more relaxed eligibility rules may be a way to attract new employees while meeting the extended eligibility rules may help retain employees.

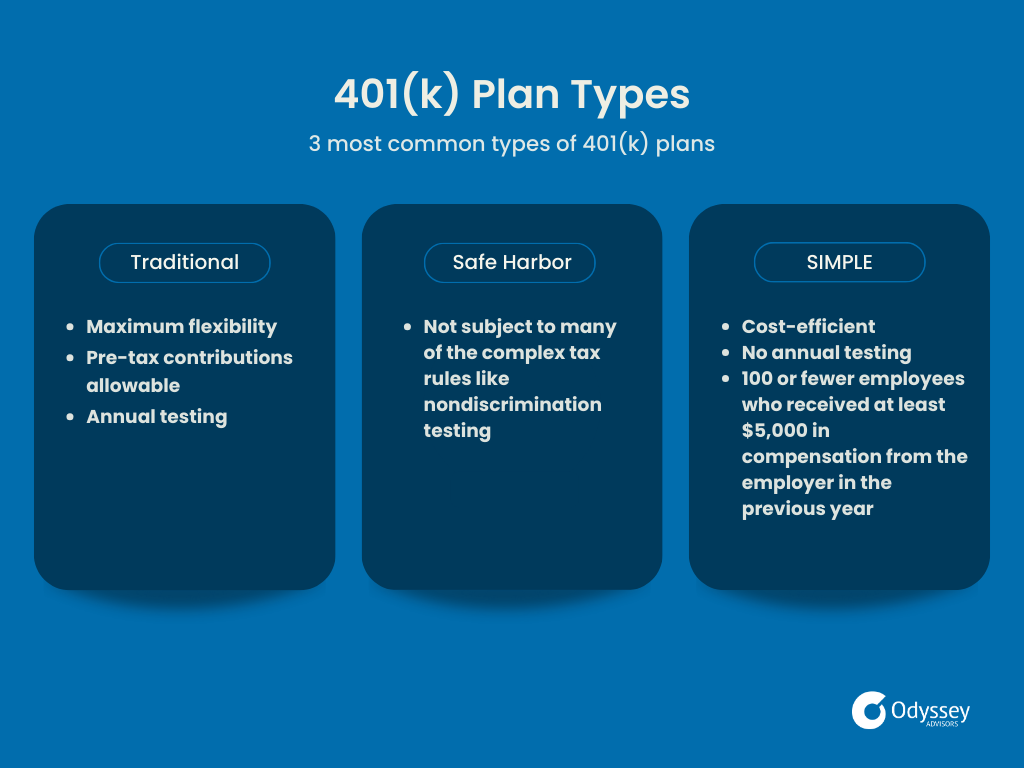

2. Plan Type

There are 3 common types of 401(k) plans that you can choose from to best suit the needs of your company:

Traditional Plan

- Offers maximum flexibility

- Allows participants to make pre-tax contributions

- Annual testing

Safe Harbor Plan

- Not subject to many of the complex tax rules such as nondiscrimination testing

SIMPLE Plan

- A cost-efficient way to offer retirement benefits to employees

- Not subject to annual nondiscrimination tests

- 100 or fewer employees who received at least $5,000 in compensation from the employer for the preceding year

- Employers can’t maintain any other retirement plans

Additional reading: Step-by-Step Guide to Starting a 401(k) Plan

3. Contributions

Employee Contributions

Employee elective deferrals are subject to limits. In 2024, the maximum allowable contribution is $23,000 for traditional and safe harbor plans and $16,000 for SIMPLE 401(k) plans. Additionally, employees aged 50 and above can also make “catch-up” contributions, allowing them to contribute beyond the standard limit. In 2024 eligible participants can contribute an extra $7,500 for catch-up contributions.

To streamline the process and promote retirement savings, some plans offer automatic enrollment. This feature enrolls eligible employees into the plan by default unless they choose to opt-out. Automatic enrollment is designed to boost participation rates and encourage more employees to start saving for their future.

Employer Contributions

Many employers opt to match a portion of their employees’ contributions or make nonelective (aka “profit sharing”) contributions which can be tax-deductible on the employer’s federal income tax returns. However, these matching and/or nonelective contributions must adhere to IRS limits.

In addition, all 401(k) plans are required to undergo non-discrimination testing to ensure fairness between highly compensated and non-highly compensated employees. Understanding these tests is crucial for maintaining compliance with regulations.

4. Vesting

Vesting refers to the ownership of the funds an employer contributes to an employee’s account. It indicates how much of those funds an employee owns and can take with them if they leave the company or retire. As the employer, you can set the vesting schedule. Employers typically choose between two types of vesting schedules: graded vesting and cliff vesting.

Graded vesting schedules gradually grant more ownership of employer contributions for each year of service. For example, a plan may state that an employee becomes 25% vested for each year of service until they are 100% vested. You can choose the rate at which vesting occurs, as long as it’s at least as generous as the minimum of 20% vested at two (2) years increasing by 20% per year until the employees are fully vested at six (6) years.

Cliff vesting schedules hand over full ownership of contributions after a period of no ownership. For example, a plan may state that the employee must complete two (2) years where then they will be 100% vested. Cliff vesting schedules require that employees are 100% vested upon completion of three (3) years of service.

It is important to remember that vesting refers to employer contributions. The money that the employee puts aside through elected deferrals is always immediately 100% invested.

5. Investment Options

Where will the plan assets be invested? Index funds are a popular choice due to their diversity and low maintenance requirements. Plan sponsors should regularly monitor investment options to ensure they are optimal for employees. Whatever you choose, compliance with ERISA 404(c) mandates a diverse range of high-quality investment options as well as employee education so that they can make informed choices.

6. Plan Administration

Some companies hire a third party administrator or “TPA”. Rather than spending time and money to train someone regarding retirement plan rules, a lot of companies choose to hire an outside expert. The TPA is responsible for running the plan. This entails making sure that the plan remains compliant with ERISA standards, communicating with the company answering questions, and helping to minimize claim and administrative fees.

7. Distributions

Retirement plans offer various distribution options for participants. When an individual leaves employment, they may have the choice of receiving a lump sum distribution, where they take the entirety of their vested account balance at once. Some plans may also offer installment payments or partial distributions.

Some plans allow participants to request distributions while still employed, known as “in-service” distributions. These may be granted upon reaching a certain age, typically 59 ½ or older, or in the event of a hardship that is defined by the law.

Additionally, if a participant decides to move to another job, they may elect to do a rollover, a type of distribution, where the funds from an existing account are transferred to a new retirement plan or IRA tax-free.

Every Detail Matters

In crafting a 401(k) plan, every detail matters, from the type of the plan to contribution structures, vesting schedules, and distribution options. There is no such thing as a one-size-fits-all 401(k). It’s also important to remember that you must clearly outline the details you choose in your plan document.

If you have any questions about your plan design – or are looking for a third-party administrator to help design your retirement plan – contact us today.

Looking for more? Explore these excellent articles on retirement plans and design:

How Much Does it Cost to Start a 401(k) Plan?

Understanding Asset Allocation

Top 3 Employer Fiduciary Responsibilities for 401(k) Plans

Categories: 401(k), Retirement

About The Author Luke graduated from the University of Connecticut with a B.A. in Actuarial Science. He brings a strong mathematical and analytical background to his role as a Consulting Actuary at Odyssey Advisors. He designs and maintains complex client-employee benefit programs...

More Insights From This author

April 6, 2023

Luke Matchett