What are Profit-Sharing Plans?

August 31, 2021|Stephanie Irvin

Bottom Line Up Front

- Profit-sharing plans are defined contribution retirement plans that permit employers to contribute discretionary amounts in order to provide employees with a share of the company’s earnings.

- 401(k) plans can be added as a feature or subset of a profit-sharing plan in order to allow employee contributions.

- There are three types of profit-sharing plans: new comparability, age-weighted, and pro rata.

Share in the success of your business with your employees and they’ll adopt a greater sense of ownership in the work they produce ultimately leading to greater productivity and employee loyalty.

When it comes to sharing your company’s success with your employees, what comes to mind? Stock options? Bonuses?

Before you jump on either of those, let’s chat about profit-sharing plans.

What are profit-sharing plans?

Despite the name, your business doesn’t need to make a profit to adopt a profit-sharing plan. They should probably think about renaming them. So, what exactly is a profit-sharing plan?

A profit-sharing plan is a type of defined contribution plan that allows employers to make discretionary contributions to their employees’ retirement accounts based on the company’s earnings.

This type of plan is popular because it provides benefits for both you (the employer) and your employees. Contributions are usually made based on the company’s quarterly or annual earnings, hence the name. The actual amount is determined by the employer and varies on an annual basis.

Is a profit-sharing plan the same as a 401(k)?

No, a 401(k) plan is actually a feature or a subset of a profit-sharing plan. So they are related but accomplish different purposes. The biggest difference between these two plans is an employer’s flexibility when making contributions to their employees’ accounts.

With a typical 401(k) plan, the employees may contribute to their own accounts. Some 401(k) plans include an employer match where they will match their employees’ contributions up to a certain percentage.

With a profit-sharing plan, only employer contributions are allowed. The IRS notes that you will need to have a defined formula (this may be discretionary and change year-to-year) that determines how contributions are divided among the plan’s participants.

How does a 401(k) profit-sharing plan work?

A 401(k) profit-sharing plan allows both employees and employers to make discretionary contributions. As noted above, a profit-sharing plan by itself does not allow employees to make their own contributions which is why most employers will pair a profit-sharing plan with a 401(k) plan.

These plans provide the employer the opportunity to make bonus contributions to their employee’s retirement accounts. The amount may be the same for all employees (dollar amount or a percentage of pay) or it may vary by participant or job class. A profit share contribution is generally discretionary, which means certain years may have a higher contribution, while others may have a lower contribution or no contribution at all. The amount you contribute is completely up to you as long as you are following a set formula. The amounts can range from $0 to the maximum contribution limits set by the IRS:

The annual additions paid to a participant’s account cannot exceed the lesser of:

- 100% of a participant’s compensation, or

- $66,000 ($73,500 including catch-up contributions) for 2023

Types of profit-sharing plans

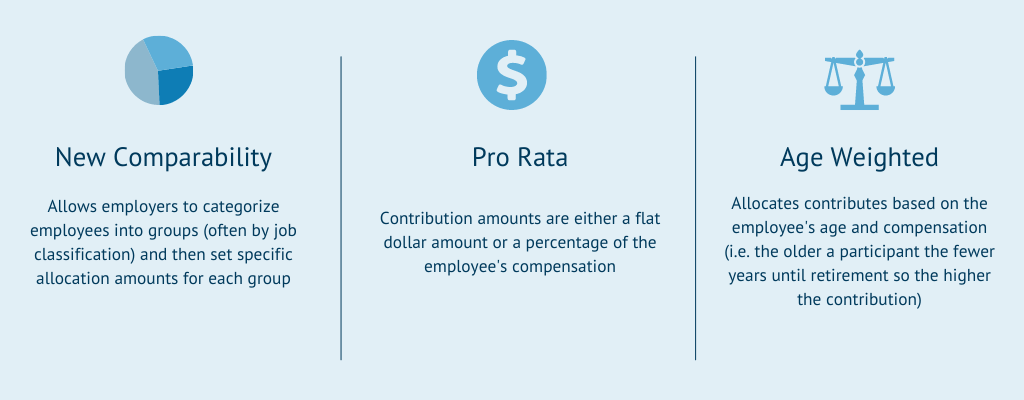

There are three primary types of profit-sharing plans:

- New Comparability 401(k) profit sharing

- Age-Weighted profit-sharing plans

- Pro-rata plans

New Comparability 401(k) Profit-Sharing Plan

A new comparability plan is a type of defined contribution profit-sharing plan that allows for more flexibility with contributions. Employers who use this plan can increase contributions for specific employees (typically older, key employees). Rather than strictly following a percentage of compensation formula, employers can divide their employees into different groups (often by job classification) and then have different allocation amounts for each group.

These plans do require nondiscrimination testing to ensure that the benefits provided do not overly favor highly compensated employees (“HCEs”).

Age Weighted Profit-Sharing Plan

An age-weighted profit-sharing plan allocates contributions based on the employee’s age and compensation. The older the participant the fewer years until retirement so the higher their contribution. If properly designed, this plan meets a “safe harbor”, meaning that it will pass automatic nondiscrimination testing because older employees have less time to grow their contributions until retirement.

Pro-Rata Profit-Sharing Plan

Pro-rata plans are the most common profit-sharing plans because they are the easiest to manage. The contribution is either a flat dollar amount or a percentage of the employee’s compensation. To illustrate, let’s say that an employer has set their percentage at 5% so each participant would receive a profit-sharing amount that equates to 5% of their compensation (this compensation is limited by an indexed IRS annual compensation cap).

What are the benefits of a profit-sharing plan?

- It builds your employees’ sense of ownership and loyalty. Profit-sharing plans allow employees to share in the success of the company. This leads to a gained sense of ownership and loyalty to the company which leads to increased productivity and efficiency

- Helps attract, recruit, and retain top employees

- The contributions are tax-deductible

- Annual employer contributions are flexible

Does a profit-sharing plan have any disadvantages?

- It may cause a shift in employee focus. Sometimes it can cause employees to start prioritizing profits over quality

- Contributions cannot be made based on performance. This means that employees who contribute less will receive a similar contribution as their higher-performing peers

- Eventually, some employees may view it as a regular entitlement rather than a motivational incentive

How are profit-sharing plans taxed?

Let’s break this one down based on contributions, earnings, and distributions (or withdrawals).

Contributions and earnings

Any contributions or earnings made on the investments in the accounts are considered tax-deferred. These contributions are tax-deductible for the plan sponsor making them a great benefit for growing companies.

Federal and state governments will not tax the contributions or earnings until they are distributed. Certain state governments will treat all or a portion of the retirement income as non-taxable so it’s important to review your state’s taxation policy.

Typically, you will pay the taxes when you withdraw from the account in the future.

Distributions or Withdrawals

Anytime a withdrawal is made from a profit-sharing plan, it must be reported on the participant’s individual tax return. Any distributions or withdrawals from the account are considered taxable income.

If you’d like to schedule a free consultation to discuss your retirement plan options with an Odyssey Advisors consultant, you can reach us here. No worries if you’re not ready for a consultation! Feel free to leave us your questions, comments, or concerns in the form below.

Categories: 401(k), Retirement

About The Author Stephanie joined the Odyssey Advisor’s team all the way from the Lonestar state in November of 2020. She is versatile in her abilities and has experience in copywriting, photography, and analytics. She helps tell our brand story and convey...

More Insights From This author

October 15, 2024

Stephanie Irvin

November 29, 2023

Stephanie Irvin

November 15, 2023

Stephanie Irvin